Credit card issuer's fraud detection tactics are having a negative impact on your legitimate online transactions

The impact of credit card issuers dramatically increasing fraud detection tactics is having a profound impact on legitimate customer-initiated transactions. Merchants are left trying to figure out whether they’re seeing traffic quality issues, possible fraud, configuration issues, or just terrible luck. Tragically for the merchants, the impact to the bottom line is unavoidable.

We have solved the mystery of card issuer decline rates

Card Insight has leveraged over a decade of experience in ecommerce marketing, along with 3 years of focused analysis, experimentation and tech development to determine…causation. What causes a specific card-holder’s transaction to decline and what causes approval rates in aggregate to suffer? We’ve analyzed millions of transactions to understand the relevance of specific variables such as MCC codes, price-points, acquiring bank, gateway, 3DS and more.

We have the strategies to maintain consistently high approval rates and have the data to prove it.

Your mid reputation begins even before you run a transaction

Believe it or not, each MID will have a baseline reputation even before you run a transaction. You can have a MID with the same MCC, same media source, same price-point but from two different banks and have approval rates that differ by 10-20%. That MID reputation is managed by risk systems monitoring every aspect of the transaction:

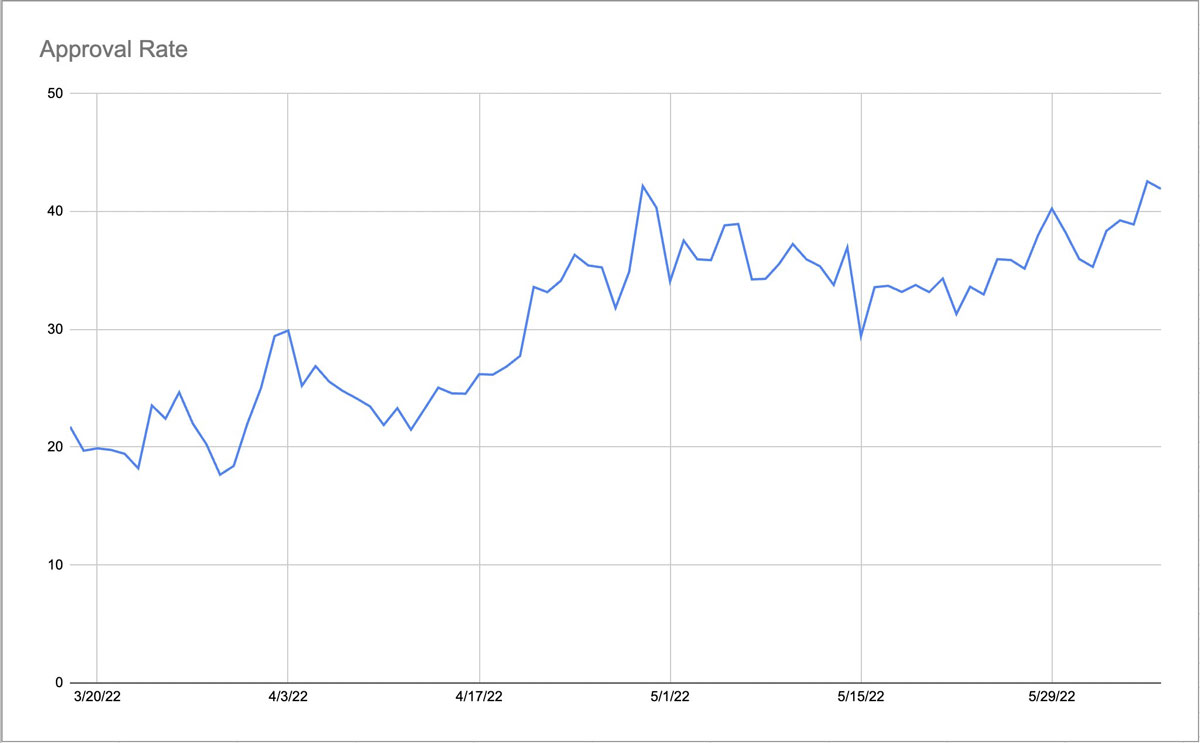

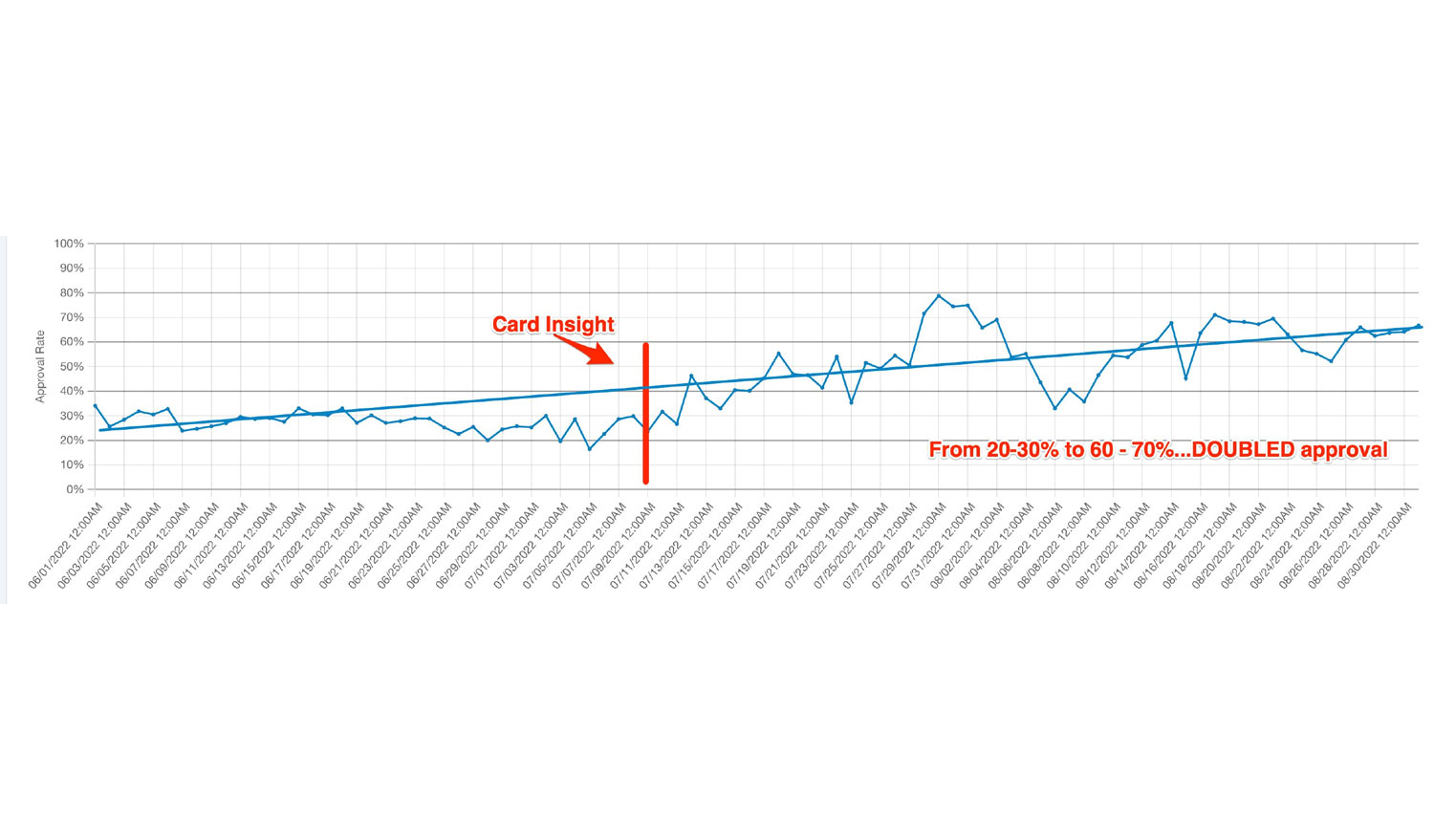

Actual Client Results:

Let us improve your credit card approval rates

With a focus on approval rate, we have been able to see astounding client success on both initial and rebill transactions. Though each scenario is different, gains have been in at least the 5-10% range, with literal doubling of approval rate and many clients experiencing gains of 20-30% or more.